At Southbourne Group, we pursue a time-proven investment philosophy and focus on people’s needs. This is how we have survived some of the most turbulent markets in investment history.

How Earn Thousands with these 8 Dividend Investing Tips

How Earn Thousands with these 8 Dividend Investing Tips

Look over these valuable guidelines before you invest in anything else.

Although dividend stocks do not seem to be as attractive as high-growth stocks, acquiring and holding them can produce high returns for investors who have the patience to wait. However, with the market staying at unprecedented peaks and interest rates poised to increase, investors need to be extremely discriminating when it comes to dividend stocks. The following eight useful tips will guide you into the most efficient strategies for your portfolio.

1. High yields are not enough. High yields are fine; however, focusing on them can lead you to miss the issues that might undermine or suspend the dividend. Likewise, you could lose your way around strange sectors and strange companies, bringing us to the next related tip.

2. Avoid sectors unfamiliar to you. Last year, an investor bought stocks of the shipping container company Textainer because he was attracted to the company's high dividend yield (more than 6% then) and low valuations dividend yield; however, he did not realize that the seasonal shipping container industry experienced an extreme dip as a result of the glut of containers worldwide, inexpensive steel and China’s economic decline. Textainer suffered from those factors and had to reduce its dividend twice, leading to the stock’s drop.

3. Evaluate the payout ratios from the start. Look beyond a stock's projected yield and take the dividend as a percentage of the company's earnings and free cash flow to find out if its payouts can be sustained. For instance, Casino giant Las Vegas Sands paid 137% of its earnings and 126% of its free cash flow on dividends for the last year -- suggesting a reduction of their 5.1% yield in the coming months ahead.

4. Measure valuations according to comparable peers in the industry. The recent years saw many dividend stocks catching up as a result of a low-interest rate condition, making bond yields not so appealing. However, as interest rates and bond yields increase, many investors will begin selling their income stocks -- especially those that have much higher valuations – in favor of bonds. Tobacco big-player Altria was a popular and secure market choice; yet it now trades at a level of 26 times its earnings, a level way above the average of 21 in the industry.

5. Aim for stable earnings and growing free cash flow. When a firm regularly has both figures on the rise, it can give out dividends consistently. However, if the two sink to the bottom, expect a cut in dividends. As a prime case, Las Vegas Sands gave out $2.9 billion in dividends in the past year. Checking out its unstable net income and FCF growth in the last three years, however, shows how undependable its dividend really is:

6. Evaluate its track record of dividend increases. Firms that aggressively promote their stocks as income investments tend to raise their dividends yearly. Those that have done this for more than 25 years enter the list of elite "dividend aristocrats", such as AT&T, which has increased its dividend yearly for more than 30 years. Companies such as these tend not to cut or stop paying dividends in spite of a severe financial meltdown worldwide.

7. Get a DRIP (dividend reinvestment plan) to reinvest your dividends. If you can afford to reinvest dividend income immediately, enroll our stocks in a DRIP, allowing you to automatically acquire additional shares of the stock while getting a little price discount in the market. You will benefit from: savings in commission charges, averaged purchase price over time and automatic increase of your position due to the compounding effect.

8. Consider your effective yield. As a stock’s price rises and its yield dips, investors usually sell the stock to acquire one with more returns. In that case, the investor has not considered his or her "effective" yield, which is the percentage the stock effectively yields based on the price of the principal.

For instance, AT&T presently has a forward yield of 4.8%. But an average AT&T purchase price of $33.74 will grant an "effective" forward yield of 5.8%. Hence, one will hesitate to trade his AT&T shares for another stock with a 6% yield.

The key takeaway

There are no foolproof steps for selecting the winning dividend stocks. However, putting your trust on those stocks you are familiar with, monitoring their valuations and payout ratios instead of yields, and putting back your dividends into the investment will go a long way toward gradually building wealth for you though the going gets rough.

Where to Keep your Cash

Where to Keep your Cash

If you are holding on to some amount of money now and you want to stash it away somewhere, you might be led to choose the nearest or the most available financial institution already knocking on your door. Do remember that it is not about them but about you, the owner.

Deciding on the best kind of short-term savings account requires satisfying your own best interests and needs in such areas as the following:

Accessibility: Which do you prefer to use to access your account – check, ATM, online and others? How frequently do you expect to use it??

Interest Rate: Is the interest rate your bank or institution giving the highest you can get? If not, scout around for a better deal, if you can.

Quality of Service: Do you demand personalized service or are you more comfortable doing things yourself or do you prefer some minimal customer assistance?

Penalties: In case you have a change of mind and want your money back sooner, what penalties will you incur?

It will help us assess the candidates now:

Checking accounts

Generally, checking accounts best serve business transactions, not just personal savings. Most checking accounts, therefore, do not pay interests although there are banks who bundle the facilities of checking with money-market account earnings. Likewise, "asset management" accounts provided by brokerages which contain several attractive features, such as limitless check-writing, use of ATM access, and high money market interests, making brokerages more appealing to people with time.

Benefits

You can access your money readily with a check or an ATM.

Also, if you long for the traditional personalized bank services of a teller, your bank is just around the next street corner.

Federal Deposit Insurance insures checking accounts like they do every bank account.

Downside

Your bank may not offer any return on your deposit; or if it does, it might be very minimal as to matter.

As most of us know, checking accounts may require a minimum retaining deposit or bank services charges --- maybe both, which could make you think twice before getting one.

Savings accounts

Formerly, savings accounts (also referred to as passbook accounts) were the most common places to keep money for a short duration. However, people are learning to stash away their treasures in investment instruments that offer greater returns. Today, savings accounts have practically shrunk in their ability to make money for you, if you have not noticed yet.

Benefits

FDIC insures your savings account to a certain amount.

You can open an account with a minimal starting deposit.

Downside

You get almost nothing for parking your money with a bank – a parking meter makes a lot more money just standing there.

Bank accounts with high returns

Today, savings and checking accounts can provide high returns, making them great money storage to cover your essential expenses. Flexible and liquid, these accounts allow you to put in or take out conveniently and any time you want to. There are some which offer interest rates equal with more exclusive investments, such as CDs. You can gain extra mileage on your money if you apply for an online-only bank which saves on costs by having fewer features than those offered by other accounts.

Benefits

Higher returns compared to conventional bank accounts.

FDIC insures high-yield accounts at par with other accounts.

Downside

Online banking can constrain you access to your money without the conveniences of checks and ATM cards.

Clients need to arrange their expenses by moving money to and from the online bank to a linked checking/savings or brokerage account. If you cannot wait for the usual delays – up to almost a week at times – for transactions to clear, then this may not be for you.

Beware of limited-time promo rates by investigating the provider’s six-month interest rate stats.

Money-market deposit accounts

Banks also provide money-market deposit accounts which often demand a minimum deposit balance, and allow a certain number of monthly transactions (six transfers, which include three checks issued on the account).

Benefits

Money-market deposit accounts can be easily accessed using checks, ATM cards and cash transfers.

FDIC insures money-market accounts like all bank accounts.

Downside

Because of the conveniences, you get lower returns compared to certificates of deposit.

You can be charged with penalty fees for going below your minimum balance or when you make more than the allowed number of transactions.

Money-market funds

Mutual families and brokerages provide money-market funds which are funds invested in highly-liquid, safe securities, e.g., certificates of deposit, commercial paper (short-term obligations offered by companies) and government securities.

Benefits

Money-market funds can be accessed readily using checks or ATM cards – a boon for the eager beaver.

Money-market funds often higher returns than money-market accounts.

Issuers of these funds work overtime to maintain the NAV (the funds’ unit price) at $1, making your principal rather secure.

Downside

FDIC, unfortunately, does not insure money-market funds.

The NAV limit may go higher than $1.

Certificates of deposit (CDs)

Debt instruments, such as CDs, have a prescribed maturity, between 3 months to 5 years.

Banks usually issue CDs although brokerages also offer them.

Benefits

CDs are quite secure because they are FDIC-insured.

CDs can provide higher yields than money markets, especially if they have longer maturity periods.

Downside

You will have to wait for the CD to mature before you can get hold of it. Nevertheless, you can withdraw it earlier but with a penalty charge.

U.S. government notes or bills

Also called "treasuries", these notes or bills are fully secured by the trust and credit of the U.S. government. Treasury bills take less than one year to mature; while treasury notes take 2 to ten years to fully mature.

Benefits

These are considered the safest investments in almost all countries.

You can buy these directly and commission-free, at TreasuryDirect.

They are also exempt from local and state taxes.

Downside

In terms of yield, you might be able to find higher returns from CDs, money markets and corporate bonds.

Withdrawing your money before maturity may cost you some losses on your original investment.

I Bonds

I Bonds are inflation-indexed savings bonds offered by the U.S. government which yield inflation-adjusted semiannual returns, thus, protecting your money’s buying power.

Benefits

The US government also fully guarantees I Bonds.

You are protected against inflation -- a capital personal “I” for any investor.

Many will be happy to know that these bonds are available in affordable denominations, as low as $50 and as high as $10,000.

You can acquire them from any reputable financial institution, as well as at TreasuryDirect.

Your returns are tax-exempt, locally and state-wide, and can also be tax-free if applied for post-secondary education purposes.

Moreover, taxes on your earnings can be deferred for as long as 30 years.

Downside

The minimum holding period for an I Bond is one year 12 months, and if you redeem it within less than 5 years, you have to pay a penalty equivalent to your three months' earnings.

Municipal bonds

Also called "munis" by the big players, municipal bonds are offered by local and state governments for the purpose of constructing schools and other public infrastructure projects. Munis appeal mostly to high-income investors seeking tax-friendly returns.

Benefits

Munis are almost as secure as U.S. securities.

Munis are exempt from federal taxes, and, perhaps, also local and state taxes, especially if you reside in the town government that issued the bond (look into the tax advantages before buying).

Downside

Munis offer comparatively lower Interest rates. If you belong to a high tax category, you can get better returns from other investment options.

You must shell out a commission to purchase munis.

Like some other investments, you cannot get all your money if redeem it before the maturity date.

Corporate bonds

Corporate bonds are debt bonds offered by firms, ranging from the high-yielding blue chips to the less-productive "cow chips". The higher the creditworthiness of the issuing company, the lower interest it pays. Moody's and Standard & Poor's classify firms that issue these bonds according to their ability to pay out their debts. Remember that only short-term bonds are suitable for short-term savings.

Benefits

Corporate bonds often give higher returns compared to money markets, government securities and CDs.

Downside

The issuing firm may end up defaulting on interest payments or even totally fold up.

Commission fees are charged to buy these bonds.

In case you have to withdraw your money, you will not get back your original invested amount.

Bond funds

Bond funds are mutual funds that put together investors’ money to purchase bonds of all kinds.

Benefits

These provide an attractive means to buy bonds in affordable denominations while providing the diversification to reduce the risks of picking out dud bonds from sluggard companies.

Downside

The NAV or the share price of a bond mutual fund varies, as interest rates of the bonds bought and sold within the fund fluctuate. As a result, it is uncertain whether you can recover your original investment when you need to. Moreover, returns on a mutual fund can fluctuate.

Owning the fund requires you to pay an ongoing expense called the "expense ratio" as well as a commission fee or "load".

The Perfect Time to Invest

The Perfect Time to Invest

In trading with stock, timing does not matter as much as time itself.

Most novice investors fret about the timing of their first stock acquisitions. Kicking off from the block at the wrong time within the market's fluctuations can mean being left behind holding nothing but your shirt and pants.

Not to worry! For first investors, time is your friend. In the long run, the compounding effect of a properly researched investment will yield high returns, no matter how the market was doing at the time you bought the shares.

Use your time well

Instead of worrying about when to buy your first stock, focus on the length of time you plan to hold your money in the market. Each investment provides its own unique levels of risks and returns and, as such, has its own unique and suitable investing time requirements.

Most bonds generate smaller and steadier returns for investors who prefer short-term investments. Ibbotson reports that short-term U.S. Treasury bills generated approximately 3.7% annual returns from 1926 to 2003, 2003 being the tail-end of a bear market. Although the figure is not so attractive today, we have to consider that inflation was almost nonexistent during that period; earning 3.7% average annual return then would have been a desirable level before the turbulent 1970s.

For longer investments, such as government bonds, one can gain a somewhat better return, which had an average annual gain of 5.4% from 1926 to 2003. Unexpectedly, such gains were comparatively volatile. For example, in the 1980s, they generated almost 14% per year while, in the 1950s, they lost an average of about 4% annually.

In general, stocks have also benefitted investors. Large-cap stocks, for instance, offered an annual average of 10.4% from 1926 to 2003 – relatively a step higher than bonds. Nevertheless, the range of the returns for stocks is nowhere higher than that for bonds during the same time frame. Stocks declined slightly in the 1930s but also regained during some significantly solid decades, during the 1950s (at an average annual return of 18%), the 1980s (16.6%) and the 1990s (17.3%). We can all appreciate that consistent performance of stocks.

At what point will you need the money?

Keeping your investment for a longer period will allow you to grow your money as you will have the time to weather periods of low returns and to accept risks.

However, if you want your money within the five years from now, you may have to forget individual stocks and stock-centered mutual funds. In case your time frame is only three years, you must likewise leave out bond mutual funds and real estate investment trusts (REITs), which tend to go down as interest rates climb.

Having eliminated those choices, what do you have left? You can invest in individual bonds or certificates of deposit (CDs) which have less than three years durations, in a money market fund, or in a savings account. Each of these options delivers returns while assuring you of getting your principal back. With your short time-frame requirement, you cannot afford to accept more risks for your money.

Nevertheless, stocks can provide potentially high returns you will need for your long-term objectives, such as a dream house or retirement. Many cannot pass up the opportunity to gain higher returns.

When to sell

Having decided where to invest and when to invest, your next hurdle is when to recover your money. This will not cover bonds which automatically sell themselves once they mature; but it will cover stocks or stock mutual funds.

Some “expert” investors claim to have the ability to "divine" the market’s timing, knowing its rise and fall. With their advice, you will need to sell their stocks just before the market drops, or buy them all back as the market gets ready to climb. Sadly, if it were all that simple, these “experts” would all be vacationing in the Maldives and in Monaco, instead of spending their time selling their expertise to other investors.

Be that as it may, when you see a general economic crisis crushing corporate revenues and companies folding up, you have no other choice but to unload some of your expensive, lower-quality investments. Aside from such overall dire economic events, we cannot find a foolproof method for timing the market’s movements.

Many investors in mutual funds withdraw their cash as soon as returns slow down. However, some academic researchers claim that butterfly investors who fly from one fund to the other, looking for performance, end up worse than those who remain in place. The simple rule is: Stick it out with a fund no matter what happens – except for one case.

An actively managed fund provides protection through a dependable professional money manager. However, if that he or she leaves your fund to manage another, another manager will take over to handle your money with the same expertise – although you can always decide to sell instead. Remember that three or more lean months are not enough reason to bail out.

In selling stocks, you need to consider two warning signs that will compel you to sell:

When the company’s fundamentals change:

The possible presence of a new competitor has made its essential products obsolete. The business may have branched out into concerns significantly disconnected from its central skills, confusing your appreciation of their business.

The stock becomes overvalued:

The market may have bid the company's shares up to unsupportable levels. The stock may crashed based on the smallest negative press releases. The risk of such a fall may outweigh any tax hit you would take if you sold today.

With these two questions in mind and carefully considered, you may ignore other warning signals on the horizon.

Do not let the market buzz bother you

Media focus on Wall Street activities, although concentrating mainly on a single index, as if it represents the market as a whole. High index level? We have a bullish market! Index is down? The bear market is here! Index fluctuates? We have a volatile market!

There are investors, especially those who are essentially technical analysts, who observe market fluctuations to determine whether investors will take the market higher. For us, this is a meaningless exercise. In the long run, effective investing does not depend on understanding the market as a whole, but on comprehending the strengths and weaknesses of each concerned companies. In spite of the noise and the hype going on in the market, buying and holding on to your investment is still the finest method to gain sound long-term benefits.

Review, review, review

On the other hand, you may decide to fill your portfolio with only a few stocks – no matter how judiciously picked -- and leave them to germinate. Just like plants, investments require periodic care and attention in order to grow. But if you do not have money in government bonds, which have guaranteed rates of return, you will have to monitor your investments now and then to see if they are afloat -- and doing so more aggressively and economically than other, like alternatives.

Assessing your investments, especially when you make mistakes, provides a vital lesson for future growth. Learn to overcome such errors by not repeating them your success depends on it. Spend enough time to evaluate your portfolio every quarter, at least – but weekly is better. Although you do not need to sit -- and sleep -- before your computer to monitor your investments, never leave them unattended either.

Beyond the basics

There you have it – with your first lessons in Basic Investing, may you have a happy time investing in the future! Still, there is much to learn, for instance, how to value stocks, and many more. Go slowly, relax along the way when you can and enjoy learning the adventure of investing.

Read our newsletter for free within a month. While we have different views, our diversity provides us a deep source of valuable insights, thus, making us more sound investors. We have a disclosure policy.

Winning Strategies for Beginner Investors (Part 2)

Winning Strategies for Beginner Investors (Part 2)

Company size

There are a number of investors who intentionally limit their choice of stocks from companies of a particular size, either in terms of revenue or market capitalization. This is done ordinarily by classifying companies according to market capitalization (“cap”), namely as micro caps, small caps, mid-caps and large caps. Over a long time period, bigger companies show higher returns than smaller companies do. Some investors thus believe that the size of market capitalization of companies has a great bearing on how the market responds to these companies; and the actual proportionate revenues provide a reliable indication of relative investment potentials. The generally-accepted classification followed by investors is as shown below:

Micro cap – Not more than $250 million

Small cap -- $250 million-$2 billion

Mid cap -- $2 billion-$10 billion

Large cap – Not less than $10 billion

Most publicly-traded firms are classified as micro or small caps. Statisticians are of the opinion that the apparent success of smaller businesses can be attributed to "survivor" bias rather than solid excellent performance, since the majority of the databases utilized for the tests conveniently removed bankrupt companies, up to recent times. That is, excluding bankrupt companies aided significantly in stacking the odds of success in their favor. This issue, however, remains debatable.

Screen-based investing

The “screen” method of investing is resorted to by many investors, which involves using "screens" to choose investments while applying various quantitative criteria to evaluate those companies that satisfy their criteria. Because of the ease and convenience of the method through the use of computers, it has gained a lot of practitioners. These screens can display various numerical values describing a company's status as well as its stock through different time periods.

While there are investors who use these screens to come up with interpretations of fundamental relevance to the business in general, many others utilize screens as “robot-like models" that simply point them to which ones to buy and sell. They claim that this process takes away the emotional factor in the investing process; although others think otherwise and say what you remove is the intelligence factor. Eric Ryback is widely known for his use of screens as a starting step in investing; while James O'Shaughnessy among the known proponents of screens as a pure mechanical system. As a beginner, you have to decide how you play – with the heart or with the mind or with both.

Momentum

The momentum of investing involves finding companies which do not only show good performance but also doing so well that they deserve celebrity status. "Well" is the term used to describe companies that stand out among all public companies that investors expect to show positive performance? Momentum companies, therefore, are those which frequently surpass estimated earnings per share or revenue by analysts, or post high quarterly and annual returns and sales growth compared to other firms, especially when the growth rate climbs from one quarter to the next. Such growth is a strong indication that the company is apparently doing the right things. Often, such high comparative strength is a category in momentum screens, as these investors seek to acquire stocks that have overtaken the rest of the stocks in recent months.

CANSLIM

CANSLIM is an approach originated by William J. O'Neil, who merged quantitative analysis and technical analysis, as contained in his book How to Make Money in Stocks. In O’Neil’s newspaper, Investor's Business Daily, we are told that the "C'' and ''A'' in the formula CANSLIM urges investors to find companies with fast-growing Current and Annual earnings. ''N'' is for New, to refer to business factors, such as new products, new markets, or new management. ''S'' represents Small capitalization and big volume market demand. ''L'' asks investor to determine if the business is a Leader or Laggard. ''I'' helps to spy out for Institutional sponsorship; and ''M'' focuses on the Market direction. Originally, O’Neil published Investor's Business Daily as a means for investors to apply CANSLIM; but it has turned into a general business publication patronized by all kinds of investors. CANSLIM formula incorporates features of another type of analysis -- technical analysis.

Quantitative analysis pitfalls

Since quantitative approach depends on screens which all people can see and as digital technology becomes more affordable and accessible, many of the pricing inaccuracies quantitative analysis discovers are eventually erased. Hence, if a certain screen has produced 40% yearly revenues and everyone hears about it, leading to large inflows of money into the identified companies, the returns will suffer gradually as a result.

As "unclear" as fundamental analysis may seem, sometimes having a little insight about the business you are buying can lead to a clear advantage. For example, if you utilize a high-comparative-strength screen, you must check at all times to see if the companies you discover have grown in price as a result of a merger or an acquisition. In that case, chances are the price will remain as is, even if the "screen" that picked this company had historically high annual revenues.

Technical Analysis -- Buying the Chart

What happens if you become fully convinced that all facts about publicly-traded companies were completely disseminated, giving no one any advantage whatsoever by either evaluating the business or interpreting the numbers? What does that leave you to do? You can try forgetting about beating the returns in the market by buying an index fund. There is another option which investors have taken: trying to build a set of charts that might show how other investors evaluated a stock at any certain time, specifically finding traces of large institutional investors which often lead to very significant price fluctuations. This approach, which some investors apply, is referred to as technical analysts and uses charts that practitioners believe can bring information and insight into the psychology affecting the behavior of a stock. As it is in other areas, many chart purists exist, although some investors turn to charts only to time investments after they have checked out the charts through the eyes of a fundamental or quantitative analyst.

We cannot present a step-by-step process to describe technical analysis; but various several tools exist. The most significant indicators appear to be definitive chart patterns portraying certain price fluctuations during times when the volume of trading hits a particular level. Some of the often used charts are the following: logarithmic charts, point-and-figure charts, Japanese candlesticks, and others.

Technical analysis pitfalls

Technical analysis is based on the presumption that specific chart patterns confirm indications of market psychology pertaining to either a particular stock or the market in general at crucial points. So far, much of the statistical research academics have conducted to assess whether indeed these chart forms really predict has not confirmed the supposition, as discussed by Burton Malkiel in his book, A Random Walk Down Wall Street. As with supposed new cure-all drugs or supplements out on the market, much of the trust in technical analysis revolves around anecdotal experience and not some form of durable statistical validation, unlike some fundamental and quantitative approaches which have so often successfully predicted future events. As one critic quipped, “Technical analysis is essentially as useful as reading tea leaves.”

Trading -- Doing What Works

Trading has gained such popularity, taking on celebrity status at par with such figures as Michael Phelps and Pokemons. And this happened while trading commissions have come and gone and growing numbers of people have gotten their hands on real-time information about stock prices. Commonly, traders utilize a medley of fundamental, quantitative and technical approaches with a short-term direction. This tends to make trading a high-strung activity where an investor hopes to catch a few percentage points from each trade. Hence, in spite of its popularity, trading is never a structured, rational compilation of information we can reduce into a small primer.

So many beginning investors who started out hypnotized by the perceived pie-in-the-sky appearance of trading, often lose a lot of money before discovering that with thousands of other traders running after the same pie, oftentimes, the fastest, most experienced, and most well-equipped technically are the ones who make money -- and these are usually the veteran investors and not novices. Successful trading, as every trader will emphatically say, demands meticulous focus, discipline and diligent work; so anyone who thinks that using a Quotrek while holding down a job at a fast food outlet might want to reconsider.

Arguments against trading

Obviously, trading requires much time to become good at it. Yes, we have heard of many superstar traders; but we often forget that these traders have the equipment and the time of day – perhaps, the whole day -- to trade consistently. It may sound discouraging; but considering the time and effort that most successful traders put to engage in trading; the prospects for beginners to attain the same benefits with less effort and fewer resources is quite low. With the amount of money involved in the stretch of a day to a year investment time-period, a person with limited time will potentially gain greater success in a personal business venture on a long-term basis than diving headlong into a Vegas-like environment.

Summary

For now, you may be capable of naming and defining accurately every acronym of approaches we have discussed, such as CANSLIM and GARP. Likewise, you have understood some underlying investing principles minus those odd acronyms. You know the gist of such methods as fundamental, quantitative, and technical analysis used in choosing stocks. Most probably, you will eventually devise your own peculiar style of investing. And as you increase you knowhow and expertise in this exciting adventure, you will build your personal investing philosophy that will fit your own special needs and objectives perfectly.

Nine DIY Financial Management Tips For Individual Investors

Nine DIY Financial Management Tips For Individual Investors

They say you have to spend money to make money, and this is especially true when you're seeking financial guidance. Financial advisors are well-paid for their in-depth expertise and often help their clients through decisions like investing, retirement planning and long-term savings plans.

Although it's still wise to consult a professional before any major investments, you can educate yourself enough to confidently make your own personal financial choices without the help of a professional. Nine members of the Forbes Finance Council shared their best do-it-yourself tips for individual investors looking to better manage their finances.

1. Invest for the long term.

The lure of a quick buck can guide investors to make certain investing decisions. But, unless you're a day trader, a long-term strategy is the best way to protect your assets while ensuring ROI in the long run. The market will fluctuate over time, but history shows that it tends to go up in the long run, so looking to the future will keep an investment plan focused and profitable. - Sari Holtz, DailyForex

2. Open a Roth IRA.

If you're just getting started with investing, a Roth IRA can be a great way to start. Since it is a tax-advantaged investment, it allows your wealth to grow and compound tax-free. Your investments are initially taxed, so you can make withdrawals tax-free in retirement. And, you will typically have access to a wider range of investment opportunities with a Roth IRA than you would with a 401(k). - Elle Kaplan, LexION Capital

3. Don't follow fads.

I believe that everyone can be successful in managing their own finances as long as they are well-informed. A common mistake I see individuals making is investing based on a trend or fad instead of research. Read everything you can get your hands on, and question unproven assumptions. - Mahati Mukkamala, Klaviyo

4. Purchase indexed annuities.

Sold by insurance companies, indexed annuities offer a way to participate in stock market gains while limiting downside risk. When the market is climbing, you'll share in the returns, but you'll be protected from losses by a guaranteed return even when stocks fall. The guaranteed return means that even inexperienced investors can participate without big risk. - Danielle Kunkle, Boomer Benefits

5. Take advantage of money management apps.

I personally manage my own money and regularly use apps like Mint and Robinhood. Mint keeps my personal finances in check, and I invest through Robinhood. Both have extremely low fees and are easy to use. Money management and investing aren't just for the pros anymore; the fintech trend has resulted in new resources and apps at your fingertips. - Rachel Carpenter, Intrinio

6. Invest in a lifecycle fund.

Lifecycle funds require very little work on your part. Unless you really know exactly what you’re doing, it’s the best way to go. As long as you keep stashing money away, it should keep working for you. - Ismael Wrixen, FE International

7. Look into low-cost index funds.

Paying investment professionals to manage your portfolio can often cost you a lot of money unnecessarily. When you add in the cost of actively managed investment options, the average managed portfolio will underperform the market.

The best investment most people can make, whether they're wealthy or just have a few hundred dollars to invest is a low-cost index fund. - Paul Paradis, Sezzle

Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms. Do I qualify?

8. Be resourceful with technology.

In the technological era, everyone can be successful with their finances without professional interference. Take advantage of the resources at your disposal. Thousands of apps and websites can aid in the investment process. Record keeping is a must-do, and it’s the only true way to monitor and adjust for proper spending. - Ibrahim AlHusseini, The Husseini Group

9. Budget, budget, budget.

Know how much you spend monthly and what you spend it on. If you're able save $500 to $1,000 each month and place it into an investment account, you will witness the phenomenon of compounding interest first hand. Making this systematic is the key to it actually happening. Don't look at saving money as an idea but as a way of life. You will thank yourself later. - Lance Scott, Bay Harbor Wealth Management

How to Invest for the Rest of 2017: Our Mid-Year 2017 Outlook

How to Invest for the Rest of 2017: Our Mid-Year 2017 Outlook

Heading into the second half of 2017, we believe the elongated U.S. credit and business cycle – currently eight years old and counting – will continue through the end of the year. Yet for the first time in almost a decade, the risks to the global economy are centered in the U.S. and not in other major world economies.

Growth in much of the rest of the world is stable or accelerating. In Europe, a much-anticipated credit and earnings cycle is underway, while most emerging markets are recovering from their 2015-2016 slowdowns and recessions. In our view, the biggest threat to the global economy is the prospect of the U.S. Federal Reserve (Fed) further tightening U.S. monetary policy.

Against this backdrop, we believe:

- Equities remain the asset class of choice. International equities are more attractively valued than, and likely to outperform, U.S. stocks.

- Within the U.S., we favor growth companies in an environment where macro growth will continue to be scarce.

- Long-term Treasury rates will remain low for the foreseeable future and send a message to the Fed to proceed with caution.

- Emerging market sovereign and corporate bonds offer the most attractive value in fixed income for global bond investors seeking potential total returns.

Market cycles ultimately end with tighter monetary policy and the yield curve inverting. We believe this time will be no different.

Mutual funds are subject to market risk and volatility. Shares may gain or lose value. Foreign investments may be volatile and involve additional expenses and special risks, including currency fluctuations, foreign taxes, regulatory and geopolitical risks.

These views represent the opinions of OppenheimerFunds, Inc. and are not intended as investment advice or to predict or depict the performance of any investment. These views are as of the publication date, and are subject to change based on subsequent developments.

Carefully consider fund investment objectives, risks, charges, and expenses. Visit oppenheimerfunds.com or call your advisor for a prospectus with this and other fund information. Read it carefully before investing.

Here’s how to invest in real estate — think Warren Buffett-style, not shopping malls

Here’s how to invest in real estate — think Warren Buffett-style, not shopping malls

It’s beginning to feel like a summer lull out there for markets.

But a herd of Fed speakers — including Janet Yellen — could break the pre-holiday spell and deliver a last-minute shake-up as this year’s first half wraps up today.

Stocks don’t necessarily deserve a boost, with the Dow and S&P on track for their best first half in four years. And the NASDAQ is flirting with its biggest gain since 2003 (though techs don’t look too frisky in the early going).

So, where to invest for the second half? Well, there’s lots of chatter about real estate investment trusts, aka REITs, after yesterday’s news that Warren Buffett has taken a big stake in Store Capital STOR, +0.71%.

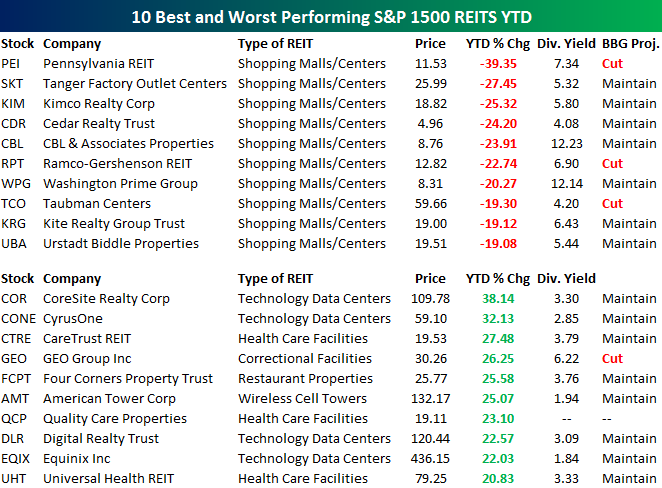

REITs can yield big profits — but only if you know which ones to buy, say Bespoke Investment Group analysts for our call of the day.

“While the shopping mall REITs have been tanking, the REITs that lease out warehouses to tech companies that need space to house all of their servers and cloud data have been surging,” Bespoke’s team says.

“The ten best-performing REITs in 2017 are all in strong uptrends, with the exception of GEO and QCP. If you’re a trend investor, you’ll like these charts,” the analysts add. (They’re referring to Geo Group GEO, -0.65% and Quality Care Properties QCP, +2.77 %.)

In other words, tech-exposed and health-care real-estate stocks have had a stellar start to the year and are likely to keep going up. Traditional retail real estate such as malls, however, faces “Death by Amazon” as shoppers shift online. That means investors should avoid that type of building, according to Bespoke.

“While there has been lots of brainstorming about what to do with malls that often look like ghost towns these days, we haven’t seen any convincing ideas yet (except maybe turning them into tech data centers!),” the analysts say.

One of Bespoke’s picks also gets praise from Forbes and Seeking Alpha scribe Brad Thomas, who singles out CareTrust CTRE, +0.57% as a “REIT gem” set for relatively speedy earnings growth.

As for Buffett’s REIT pick, that’s along the lines of what Bespoke is backing — less than 20% of Store’s portfolio is in traditional retail.

Key market gauges

Dow ESU7, -0.34% and S&P futures ESU7, -0.34% are slightly lower, while Nasdaq-100 ESU7, -0.34% futures YMU7, -0.26% are showing a bigger loss.

The dollar index DXY, -0.02% is suffering, largely because a jump in the euro. The shared currency EURUSD, +0.0000% surged to a two-week high after hawkish noises from ECB boss Mario Draghi. That drove European stocks SXXP, +0.60% lower.

Crude US: CLU7 continues to recover and is taking a stab at reclaiming the $44 level, while gold US: GCQ7 is recovering from its “flash crash” yesterday.

The chart

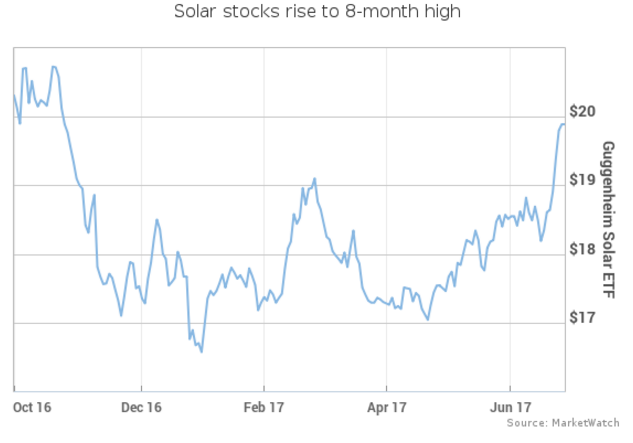

The sun is shining again on shares of solar-panel makers, which have been through a rough patch. Now they’re rallying, after President Donald Trump said last week he wanted to clad the long-promised border wall with solar panels, to help pay for it by generating power.

That helped send the Guggenheim Solar ETF TAN, +1.01% up 8% last week — the best weekly gain since December 2015 — and it continued to rise on Monday. That means it’s now trading at an eight-month high, as this chart shows.

Analysts don’t necessarily believe the wall-plus-panels will see the light of day. But it’s a positive development that Trump’s making a pro-solar statement, they noted, according to The Wall Street Journal.

The buzz

Alphabet GOOG, -0.21% GOOGL, -0.34% is getting squeezed today after the EU’s antitrust body slapped the Google parent with a record €2.42 billion fine.

Sprint S, +0.24% , Charter Communications CHTR, -1.52% and Comcast CMCSA, +1.11% are said to be in talks to bolster their wireless services.

Pandora Media shares P, -1.66% is halted this morning and the rumor mill is going nuts.

GM GM, +2.24% are waving another red flag for the car industry, warning its U.S. auto sales will fall short of forecasts.

China’s Premier Li is touting the country’s “unimaginable job growth” at the annual June meeting of the World Economic Forum, which started Tuesday.

All sorts of investing views have been getting shared at the Evidence-Based Investing Conference (West)

The economy

The flurry of Fed talk continues today, with Philly Fed’s Patrick Harker and Minneapolis Fed’s Neel Kashkari on tap. The highlight though is Chairwoman Yellen’s speech in London around lunchtime.

On the economic docket this morning are the Case-Shiller U.S. home price index and the consumer-confidence index. See MarketWatch’s Economic Calendar.

The quote

“If, however, Mr. Assad conducts another mass murder attack using chemical weapons, he and his military will pay a heavy price.” — The White House accuses the Syrian government of preparing to use chemical weapons on civilians, including children.

The stat

710% — that’s where Venezuela’s annual inflation rate stands, as the country battles with an ever deepening economic crisis. Professor Steve Hanke from Johns Hopkins University points out that it’s the first time inflation has spiked above 700% in the country since June 2015.

How to Invest in Oil without Taking a Risk

How to Invest in Oil without Taking a Risk

Bob Ravnaas raised a paddle in a Houston auction house to secure his first block of mineral rights 19 years ago, when oil prices were swooning below $20 a barrel.

A generation later, that same West Texas oilfield is still spinning off royalties, part of a mineral-rights empire amassed by Ravnaas that stretches across 20 states and delivers millions of dollars in cash payments. Kimbell Royalty Partners LP, where the former petroleum engineer is now chief executive officer has stakes in 48,000 oil and natural-gas wells in some of the hottest U.S. shale patches. These days, it’s not alone.

America’s drilling boom is making a hot commodity out of one of the stodgiest of oilfield assets, the monthly royalty check. Lured by the promise of steady returns without the cost of actually operating wells, companies like Kimbell are racing to acquire rights around the U.S. Private-equity giants including EnCap Investments LP and Blackstone Group LP are getting into the game as well, pouring billions into the market.

“It’s become a very attractive investment," said Ravnaas, whose Fort Worth, Texas, company went public in February with a $90 million offering. “Oil and gas production has increased dramatically in the last ten years, and the size of the royalty market is increasing exponentially along with it."

Drillers have negotiated with landowners for decades to tap the reserves below their acreage. But mineral rights have taken on new value as advanced drilling techniques sparked a renaissance in oilfields across the U.S. The rights guarantee holders an upfront bonus when an operator decides to drill and a cut of revenues for each barrel sold thereafter.

Generational Turnover

The growth in interest has been fueled by generational turnover. As time has passed, mineral rights have been passed down and diluted among successive generations. Descendants now see better value in packaging and selling off those rights for an upfront payment or equity in the new minerals companies, Ravnaas said.

In what was once a mom-and-pop business, $20 million deals with Texas cattle ranches or other major landowners have become more common, according to the CEO. Speculators are knocking on doors and blanketing mailboxes in hot shale plays, hoping to amass mineral rights for cheap before the drilling companies arrive.

Royalties typically range from an eighth of the per-barrel price to as high as a quarter in coveted areas like the Permian shale basin in Texas and New Mexico. Rights-holders aren’t on the hook for operating or financing costs to run the wells, although their income does depend on a driller’s willingness to keep pumping. Crude futures have fallen 14 percent in New York this year and were at $46.53 a barrel as of 10:06 a.m. on Friday.

“It’s effectively a zero-cost exposure to the minerals" said Brian Brungardt, a Stifel Nicolaus & Co. analyst in St. Louis. He tracks Kimbell and two other royalty-chasing partnerships, Black Stone Minerals LP (no relation to the equity firm) and Viper Energy Partners LP.

20 Million Acres

Collectively, the companies have spent more than $120 million to acquire new rights this year and now hold a claim on oil and gas royalties from more than 20 million acres in the Permian, Bakken, Marcellus and other shale fields, according to corporate filings.

Private equity firms have jumped in as well, seeing mineral rights as a more affordable entree into the U.S. shale boom.

In the Permian, drilling rights have reached $40,000 an acre and higher in the past year. The top price for mineral rights in the area is closer to $20,000 an acre, although competition has been pushing the tab up, said Rich Aube, co-president of New York-based Pine Brook Partners. The firm has devoted more than $100 million to royalty investments, including Brigham Minerals LLC.

“It’s a new way to invest in the same resources in a way that’s less capital-intensive," Aube said in a telephone interview. “You have a lot of folks who want exposure to these resources with a different risk profile and have found this more attractively priced."

Encap, Blackstone

Houston-based EnCap, among the biggest energy-focused buyout firms, has devoted $1 billion to mineral investments, while New York-based Blackstone has invested more than a half-billion dollars. Aube said he knew of at least a dozen other equity firms that have assembled their own minerals teams.

Representatives at EnCap and Blackstone declined to comment.

The firms are pitching mineral rights as a new asset class for investors seeking better returns in a world of ultra-low interest rates.

Viper Energy and Black Stone Minerals pay quarterly distributions that yielded more than 7.2 percent apiece as of this week, while Kimbell’s yield was projected at 5.6 percent, according to data compiled by Bloomberg. Each beats the average investment-grade energy bond yield of about 3.5 percent, according to Bloomberg Barclays index data.

“You’ve got hundreds and hundreds of landmen that are constantly putting together an acre here and an acre there and then selling," said R. Davis Ravnaas, Kimbell’s chief financial officer and the CEO’s son. “We meet a new team almost every week."

The risk for royalty collectors is that they’re at the mercy of a third party -- oil companies -- to keep the petroleum pumping. Kimbell reported a net loss in each of the last three years, after more than $40 million in writedowns related to slumping oil and gas prices.

Despite those paper losses, cash flow and production continued to grow, the company said in an emailed statement. Kimbell credited “a highly tuned acquisition strategy which focuses on only buying high quality properties with ongoing development and upside potential."

The market’s volatility puts a premium on having the right executive team, said Brungardt, the Stifel analyst.

“You need a team in place that has got the experience in not only analyzing reserves and well economics but also the acquisition side," he said. “You may be sitting on a lot of acreage, but if nobody’s interested in it, you are out of luck."

“It’s critically important to purchase not only the right rocks but the right rocks operated by the right operators," added Aube, of Pine Brook Partners. “You don’t control the pace of drilling, but that’s a judgement that affects the value of your asset and what your cash flow is going to look like over time.”

Southbourne Group Singapore, Tokyo Japan on Investment tip: How long should you run an SIP?

Southbourne Group Singapore, Tokyo Japan on Investment tip: How long should you run an SIP?

It's a question that vexes many mutual fund investors once they buy into the concept of investing through a Systematic Investment Plan (SIP): When you have a lump sum to invest, then over what period should you spread the SIP? Of course, for most SIP investments, the question does not arise. The most common type of SIP investment is a monthly one that goes out of a monthly income. This sort of SIP continues and is useful in a way to keep investing without bothering to actually take the time out and do it.

However, occasionally, the SIP investor gets a large sum of money at one go. It could be a bonus from a workplace, or it could be proceeds from the sale of some asset like real estate, or it could even be your retirement kitty which you need to spread and make it last for the rest of your life. Investing in an equity-backed mutual fund is the best way to get great returns over a long period like 5-7 years or more. However, over shorter periods, equity funds are dangerous. And when you invest at a large sum at one shot, then the risk is the highest. If the markets turn turtle, you could lose 10, 20 or even higher percentage of your invested amount very quickly. Since the beginning of the Sensex in April 1979, of the almost 13,900 possible six month periods, as many as 2,269 yielded a loss worse than 20%. If you just happened to catch a period like that at the beginning, then you would lose a large chunk of your capital right before it even starts growing. In theory, you could eventually recover, but in practice you would probably panic and pull out your money, making your loss permanent.

The antidote to this is a Systematic Investment Plan. Spread your investment at a monthly periodicity over a certain period. Your entry price will be averaged out and you will be saved from the risk of a sudden decline. Moreover, you will end up buying more units of the fund when the markets are lower, which will enhance the returns you will get. That is of course, the standard set of advantages that a SIP has. However, the vexing question is what is this 'certain period'? Is it six months? One year? Two years? Or even longer? There are arguments for and against.

Last week, I wrote about the research project on historic SIP returns that Value Research has carried out and we saw how SIP was truly safe for about four years and above. In this study, we found that on an average, if you invest in a SIP over four years, then your risk of a loss is negligible. It's also interesting that the risk of loss and the chance of an outside gain are both higher over short periods. Over longer periods, the good times and the bad get averaged out minima and the maxima converge. Consider this, for a typical fund with a multi-decade history, over all possible one year periods; the maximum returns are 160% and the minimum - 57%. Over two years, this becomes 82% and -34%. Over three, 63% and -18%. Over five, 54% and 4%, meaning never any loss. Over ten years, maximum is 30% and minimum 13% .These is all annualized figures. The trade-off is crystal clear--the shorter the period, the higher the potential gain but the worse the possible risk.

The answer from this data appears to be that SIPs must last more than three years. If you seek zero risk of loss, then that is the correct answer. However, for many investments, this is too long. If you are getting an annual bonus from your employer, it would be ridiculous to spread it over 3-4 years.

If you have sold some ancestral property and the sum realized will be the core of your old age income, then you need to be cautious about the risk you take. In a case like this, you would do well to forego some potential income to ensure that you don't make a loss. A rule of thumb is that you could invest the money over half the period that it has taken you to earn it, subject to the maximum of 4-5 years. So annual bonus could be invested in six months, while ancestral property could take five years. It's basically a way of linking risk to how significant that sum of money is for you.

5 Essential Tips for Investing in Stocks

5 Essential Tips for Investing in Stocks

Buying stock is easy. The challenging part is choosing companies that consistently beat the market.

That’s something most people can’t do, which is why investing in a diversified mix of low-cost index funds and exchange-traded funds is a smart long-term strategy for the average investor. So smart that even diehard stock jocks swear by indexing for the money they’re not using to buy individual equities.

But you’re reading this to get better at investing in stocks. We’ll assume you’ve got a yen for research, time to let your investments ride through many market cycles and have set parameters for the amount of money you’ll put on the line. (We recommend no more than 10% of your overall holdings be invested in individual stocks.) And let’s not forget this vitally important investing PSA: “Money you need in the next five years should not be invested in stocks.”

Here are five investing habits essential for success in the stock market:

· Check your emotions at the door.

· Pick companies, not ticker symbols.

· Plan ahead for panicky times.

· Build up your positions with a minimum of risk.

· Avoid trading overactivity.

1. Check your emotions at the door

“Success in investing doesn’t correlate with IQ … what you need is the temperament to control the urges that get other people into trouble in investing.” That’s wisdom from Warren Buffett, chairman of Berkshire Hathaway, oft-quoted investing sage and role model for investors seeking long-term, market-beating, wealth-building returns.

Buffett is referring to investors who let their heads, not their guts, drive their investing decisions. In fact, trading overactivity triggered by emotions is one of the most common ways investors hurt their own portfolio returns.

All the investing tips that follow can help investors cultivate the temperament required for long-term success.

2. Pick companies, not ticker symbols

It’s easy to forget that behind the alphabet soup of stock quotes crawling along the bottom of every CNBC broadcast is an actual business. But don’t let stock picking become an abstract concept. Remember: Buying a share of a company’s stock makes you a part owner of that business.

You’ll come across an overwhelming amount of information as you screen potential business partners. But it’s easier to home in on the right stuff when wearing a “business buyer” hat. You want to know how this company operates, its place in the overall industry, its competitors, its long-term prospects and whether it brings something new to the portfolio of businesses you already own.

3. Plan ahead for panicky times

All investors are sometimes tempted to change their relationship statuses with their stocks. But making heat-of-the-moment decisions can lead to the classic investing gaffe: buying high and selling low.

Here’s where journaling helps. (That’s right, investor: journaling. Chamomile tea is a nice touch, but it’s completely optional.)

Write down what makes every stock in your portfolio worthy of a commitment and, while your head is clear, the circumstances that would justify a breakup. For example:

Why I’m buying: Spell out what you find attractive about the company and the opportunity you see for the future. What are your expectations? What metrics matter most and what milestones will you use to judge the company’s progress? Catalog the potential pitfalls and mark which ones would be game-changers and which would be signs of a temporary setback.

What would make me sell: Sometimes there are good reasons to split up. For this part of your journal, compose an investing prenup that spells out what would drive you to sell the stock. We’re not talking about stock price movement, especially not short term, but fundamental changes to the business that affect its ability to grow over the long term. Some examples: The company loses a major customer, the CEO’s successor starts taking the business in a different direction, a major viable competitor emerges, or your investing thesis doesn’t pan out after a reasonable period of time.

4. Build up positions gradually

Time, not timing, is an investor’s superpower. The most successful investors buy businesses because they expect to be rewarded — via share price appreciation, dividends, etc. — over years or even decades. That means you can take your time in buying, too. Here are three buying strategies that reduce your exposure to price volatility:

Dollar-cost average: This sounds complicated, but it’s not. Dollar-cost averaging means investing a set amount of money at regular intervals, such as once per week or month. That set amount buys more shares when the stock price goes down and fewer shares when it rises, but overall, it evens out the average price you pay. Some online brokerage firms let investors set up an automated investing schedule.

Buy in thirds: Like dollar-cost averaging, “buying in thirds” helps you avoid the morale-crushing experience of bumpy results right out of the gate. Divide the amount you want to invest by three and then, as the name implies, pick three separate points to buy shares. These can be at regular intervals (e.g., monthly or quarterly) or based on performance or company events. For example, you might buy shares before a product is released and put the next third of your money into play if it’s a hit — or divert the remaining money elsewhere if it’s not.

Buy “the basket”: Can’t decide which of the companies in a particular industry will be the long-term winner? Buy ’em all! Buying a basket of stocks takes the pressure off picking “the one.” Having a stake in all the players that pass muster in your analysis means you won’t miss out if one takes off, and you can use gains from that winner to offset any losses. This strategy will also help you identify which company is “the one” so you can double down on your position if desired.

5. Avoid trading overactivity

Checking in on your stocks once per quarter — such as when you receive quarterly reports — is plenty. But it’s hard not to keep a constant eye on the scoreboard. This can lead to overreacting to short-term events, focusing on share price instead of company value, and feeling like you need to do something when no action is warranted.

When one of your stocks experiences a sharp price movement find out what triggered the event. Is your stock the victim of collateral damage from the market responding to an unrelated event? Has something changed in the underlying business of the company? Is it something that meaningfully affects your long-term outlook?

Rarely is short-term noise (blaring headlines, temporary price fluctuations) relevant to how a well-chosen company performs over the long term. It’s how investors react to the noise that really matters. Here’s where that rational voice from calmer times — your investing journal — can serve as a guide to sticking it out during the inevitable ups and downs that come with investing in stocks.

Customer support service by UserEcho